FINANCIAL ENVIRONMENTAL BULLETIN -QUARTERLY

Quarter 2, 2022

Overview.

The Quarter 2 Environmental Bulletin was prepared to review the recent economic developments in the international and domestic market. Development of the Environmental Bulletin is for commercial enterprises or organisations seeking out possible opportunities or threats occasioned by both their internal and external environments.

It’s therefore imperative for organisations to adopt to the changing environment to tap the gains.

GLOBAL OUTLOOK

As the world struggles to recover from the challenges occasioned by the Covid-19 pandemic, more challenges abound for the globe. The major issues of concern for the world economy going into the second half of 2022 include:

- The Covid-19 pandemic

- Supply-chain disruptions.

- Lockdown in China.

- Russia-Ukraine war which has had a significant impact on the world economy.

According to the World Bank’s Global Economic Prospects Report, the global economy is entering what could be termed as a protracted period of feeble growth and elevated inflation.

Global growth is expected to slump from 5.7% in 2021 to 2.9% in 2022. Significantly lower than 4.1% that was anticipated in January, hovering around that pace in 2023-24 as the war in Ukraine disrupts activity, investment and trade. Growth in advanced economies is expected to slow down by 2.5 percent and 2.0 percent in the fourth quarters of 2022 and 2023, respectively. This reflects persistent supply chain challenges, negative terms of-trade shock, weak policy responses and tighter financial conditions.

The war in Ukraine has led to a surge in prices across a wide range of energy related commodities. These higher energy prices will lower real incomes, raise production costs, tighten financial conditions and constrain macro-economic policy especially in energy importing countries.

WORLD ECONOMIC OUTLOOK.

The war in Ukraine has triggered a costly humanitarian crisis that, without a swift and peaceful resolution, could become overwhelming.

Fuel and food price rises are already having a global impact, with vulnerable populations—particularly in low-income countries—most affected. The war in Ukraine will amplify economic forces already shaping the global recovery from the pandemic. The war has further increased commodity prices and intensified supply disruptions, adding to inflation.

Even before Russia invaded Ukraine, broad price pressures had led central banks to tighten monetary policy and indicate increasingly hawkish future stances. As a result, interest rates had risen sharply and asset price volatility had increased since the start of 2022—hitting household and corporate balance sheets, consumption, and investment. The prospect of higher borrowing costs has also increased the cost of extended fiscal support.

Emerging and Developing Europe, including Russia and Ukraine, will see GDP contract by approximately 2.9 percent in 2022, before expanding by 1.3 percent in 2023. The main drivers of the contraction are the impact of higher energy prices on domestic demand and the disruption of trade, especially for Baltic states, whose external demand will decline along with the contraction in Russia’s economy. The influx of refugees is expected to place significant immediate pressure on social services, but eventually the increase in the labor force could help medium-term growth and tax revenues.

Advanced Europe. The main channel through which the war in Ukraine and sanctions on Russia affect the euro area economy is rising global energy prices and energy security. Because they are net energy importers, higher global prices represent a negative terms-of-trade shock for most European countries, translating to lower output and higher inflation.

In the United Kingdom, GDP growth for 2022 is revised down 1 percentage point—consumption is projected to be weaker than expected as inflation erodes real disposable income, while tighter financial conditions are expected to cool investment.

Middle East and North Africa, Caucasus and Central Asia: Countries in the Middle East, North Africa, Caucasus, and Central Asia regions are highly exposed to global food prices, particularly the price of wheat, which is expected to remain high throughout the year and into 2023. In the Middle East and North Africa, spillovers from tighter global financial conditions, reduced tourism, and secondary demand spillovers (for example, from Europe) will also hold back growth, especially for oil importers.

Overall, GDP in the Middle East and Central Asia is expected to grow by 4.6 percent in 2022.

Sub-Saharan & East African Economic Highlights

In sub-Saharan Africa, food prices are the most important channel of transmission, although in slightly different ways. Higher food prices will hurt consumers’ purchasing power—particularly among low-income households—and weigh on domestic demand. Social and political turmoil, most notably in West Africa, also weigh on the outlook. The increase in oil prices has however lifted growth prospects for the region’s oil exporters, such as Nigeria. Overall, growth in sub-Saharan Africa is projected at 3.8 percent in 2022.

Asia: As noted, the combination of more transmissible variants and the strict zero-COVID strategy in China has led to repeated mobility restrictions and localized lockdowns that, together with an anemic recovery in urban employment, have weighed on private consumption. Recent lockdowns in key manufacturing and trading hubs such as Shenzhen and Shanghai will likely compound supply disruptions elsewhere in the region and beyond. Notable downgrades to the 2022 forecast include Japan (0.9 percentage point) and India (0.8 percentage point), reflecting in part weaker domestic demand—as higher oil prices are expected to weigh on private consumption and investment—and a drag from lower net exports.

United States and Canada: Economic links between Russia and the United States and Canada are limited. The additional 0.3 percentage point forecast markdown for 2022 in the current round reflects faster withdrawal of monetary support than in the previous projection—as policy tightens to rein in inflation—and the impact of lower growth in trading partners because of disruptions resulting from the war. The forecast for Canada is marked down 0.2 percentage point, reflecting the withdrawal of policy support and weaker external demand from the United States.

Latin America and the Caribbean: With fewer direct connections to Europe, the region is also expected to be more affected by inflation and policy tightening. The downgrades to the forecasts for the United States and China also weigh on the outlook for trading partners in the region. Overall growth for the region is expected to moderate to 2.5 percent during 2022–23.

Key Global Risks.

A worsening war. Although a fast resolution of the war in Ukraine would lift confidence, ease pressure on commodity markets, and reduce supply bottlenecks, it is more likely that growth could slow further and inflation turn out higher than expected.

Increased social tensions: The war in Ukraine has increased the probability of wider social tensions through commodity hoarding, export controls, and domestic restrictions—with further knock-on effects on supply disruptions, prices, and social unrest. The second is the longer-term impact of the humanitarian crisis. In the longer term, large refugee inflows may exacerbate pre-existing social tensions and fuel unrest.

A resurgence of the pandemic: Although conditions are improving, the pandemic may yet take another turn for the worse—as seen, for example, with recent rising caseloads in China and elsewhere in the Asia-Pacific region. A worsening slowdown in China: A prolonged downturn in China is another immediate risk that could expose structural weaknesses such as high local government liabilities, property developer leverage, household debt, and a fragile banking system.

Inflation: Inflation expectations have so far risen substantially in only a few emerging market and developing economies. Yet with already high inflation and rising energy and food prices, higher inflation expectations could become more widespread and, in turn, lead to further increases in prices.

Higher interest rates leading to widespread debt distress: The pandemic led to record levels of public debt around the world. As interest rates rise, this will strain public budgets with tough choices around fiscal consolidation over the medium term, as pressures for social and, in some cases, defense spending may remain high.

The ongoing climate emergency: Despite some steps on the path toward a green transition, global emissions are—on current trends—very likely to overshoot the Paris Agreement temperature goals by the end of the century and lead to catastrophic climate change (with low-likelihood outcomes such as the ice sheet collapse, abrupt ocean circulation changes, and some extreme events and warming that cannot be ruled out). Indeed, the effects of warming are already starting to show: droughts, forest fires, floods, and major hurricanes have become more frequent and more severe.

Post -pandemic risk mitigations for African economies.

To engender resilient economies in Africa, governments need to:

- Speed up COVID-19 vaccination rollout.

- Increase investments in critical healthcare systems.

- Promote inclusive growth to address increased poverty and inequality

- Coordinate monetary and fiscal policy

- Reduce dependence on any single supplier of food.

- Boost local cereal production in Africa to mitigate global supply risks.

- Authorities need to ensure that their fiscal frameworks remain credible in the face of climate-related risks.

These risks can create large borrowing needs and should be integrated into authorities’ fiscal and debt management strategies, debt sustainability analysis and medium-term budget frameworks.

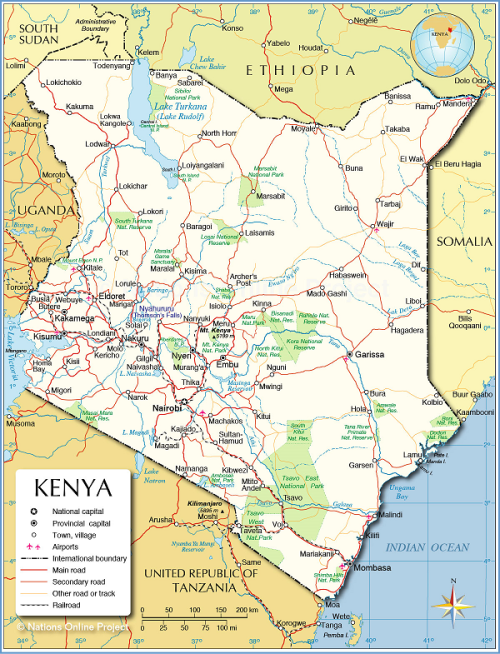

KENYA ECONOMIC OUTLOOK

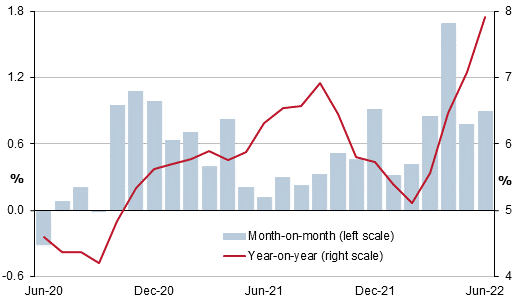

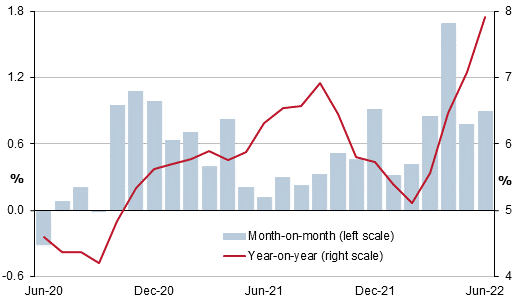

Kenya’s economy has rebounded strongly and is projected to grow 5.7 percent in 2022. Inflation moved above the Central Bank of Kenya’s (CBK) official target band of 2.5 percent to 7.5 percent in June and is expected to peak this year before easing back within the band in early 2023. Downside risks predominate in the near-term. Uncertainties stem from the war in Ukraine, continuing drought in the semi-arid regions, unsettled global financial market conditions and the political calendar. But Kenya’s medium-term outlook remains favorable.

The very strong tax performance seen in fiscal year 2021/22 has created fiscal space to temporarily cushion part of the impact of rising international fuel prices on households and businesses while still meeting program targets.

Monetary Policy Statement.

The CBK’s monetary policy is designed to support the Government’s objectives with respect to growth.

At its 30th May 2022 meeting, the Monetary Policy Committee (MPC) of the Central Bank of Kenya delivered the first rate hike since July 2015 and increased its Central Bank Rate by to 7.50%.

The decision was driven by the ongoing upward trend of inflation. The war in Ukraine has trickled down to the Kenyan economy through higher prices for wheat, fuel, fertilizer and food oils, which have bolstered food and fuel prices and fueled inflation in turn. Given upside risks to the inflation outlook, the Bank decided that a hike would help further anchor inflation expectations.

The next meeting is scheduled to take place in July.

The achievement and maintenance of a low and stable inflation rate coupled with adequate liquidity in the market, facilitates higher levels of domestic savings and private investment. This leads to improved economic growth, higher real incomes and increased employment opportunities.

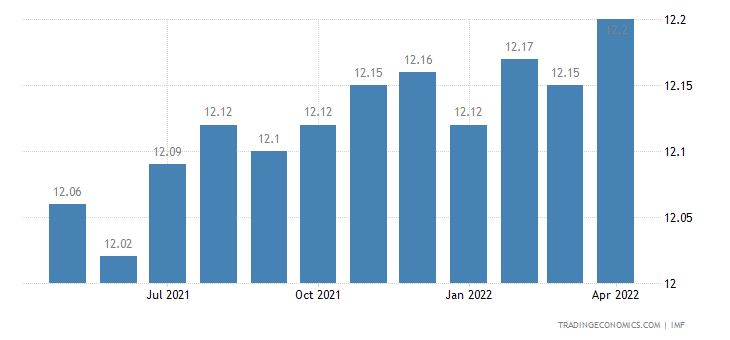

Kenya Bank Lending Rate

In Kenya, the bank lending rate is the upper rate of interest charged on unsecured loans by commercial banks to private individuals and companies.

Bank Lending Rate in Kenya increased to 12.20 percent in April from 12.15 percent in March of 2022. source: IMF

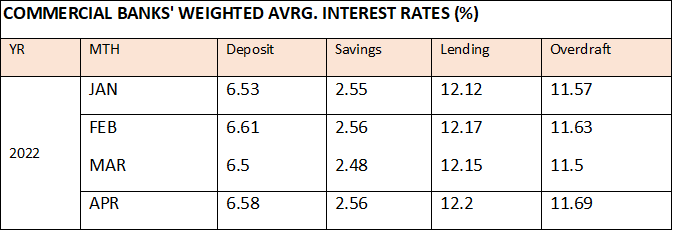

Deposit Interest Rate in Kenya

The Deposit Interest Rate is the average rate paid by commercial banks to individuals or corporations on deposits.

Kenya’s GDP growth at 5.2% in 2022

Kenya’s real GDP is projected to grow by 5.5% in 2022 and 5.2% on average in 2023–24, a robust pace but lower than the 7.5% rate projected in 2021.

Kenya’s economy grew 6.8 per cent in the first quarter of the year driven largely by the recovery of key sectors from the Covid-19 pandemic and sound macroeconomic environment. However, price hike of various food basket items drove inflation to a five-year high of 7.9 per cent in June, up from 7.1 per cent in May.

The cost of living has been rising on a monthly basis since February, hitting 7.1 per cent in May. This is partly attributed to Ukraine – Russia crisis which has stoked energy and food prices after choking the global supply chain.

In the first three months of the year, the Kenyan Shilling ceded ground against US Dollar, Pound Sterling and South African Rand by 3.7 per cent, 1.0 per cent and 3.2 per cent, respectively, in the first quarter of 2022, KNBS data shows.

The three surveys conducted ahead of the MPC meeting—Private Sector Market Perceptions Survey, CEOs Survey, and the Survey of Hotels—revealed continued optimism about business activity and economic growth prospects for 2022. Employment levels in hotels are yet to reach pre-pandemic levels. Exports of goods have remained strong, growing by 11.1 percent in the 12 months to April 2022 compared to a similar period in 2021. In particular, receipts from tea and manufactured goods exports increased. Receipts from horticulture exports declined. Imports of goods mainly reflecting increased imports of oil and intermediate goods. Tourism and transportation receipts have increased as international travel continues to improve.

The CBK foreign exchange reserves, which currently stand at USD8,179 million (4.86 months of import cover), continue to provide adequate cover and a buffer against any short-term shocks in the foreign exchange market.

The banking sector remains stable and resilient, with strong liquidity and capital adequacy ratios. The ratio of gross non-performing loans (NPLs) to gross loans stood at 14.1 percent in April 2022, compared to 14.0 percent in February. NPLs increases were noted in the building and construction, manufacturing, trade and transport and communication sectors. Growth in private sector credit increased to 11.5 percent in April 2022, from 9.1 percent in February. Strong credit growth was observed in the following sectors: transport and communication (28.9 percent), manufacturing (12.0 percent), trade (10.7 percent), consumer durables (16.1 percent), and business services (12.2 percent). The number of loan applications and approvals remained strong, reflecting improved demand with increased economic activities.

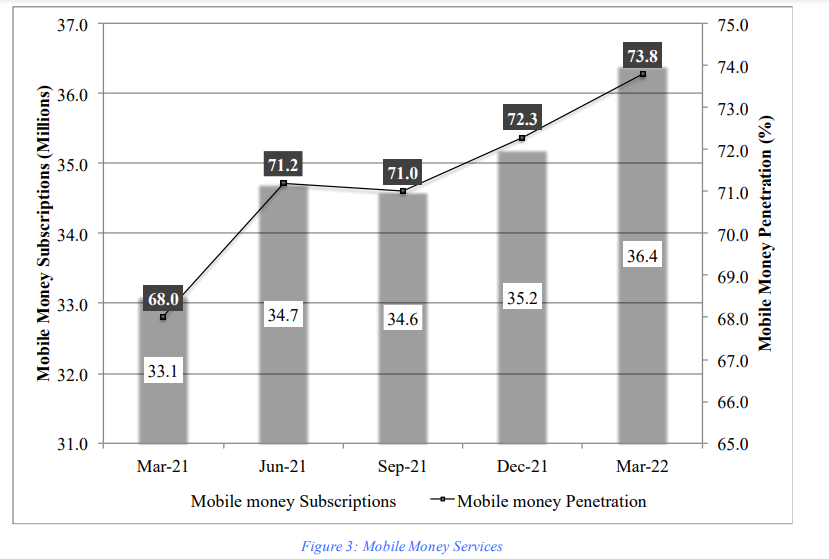

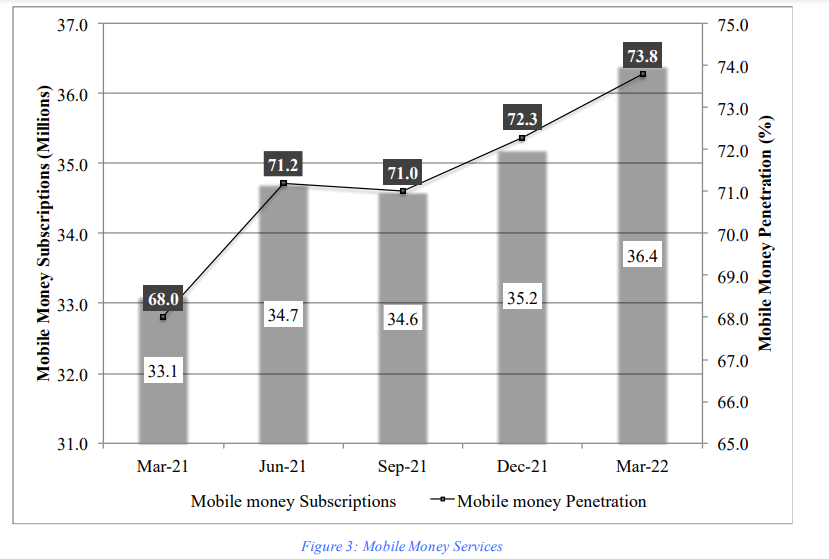

Mobile Subscriptions.

Mobile Money Services has been a driving force for financial inclusion for Kenya’s underserved and most vulnerable groups, particularly women. During the reference period, mobile money subscriptions grew from 35.2 million recorded as at the end of December 2021 to 36.4 million subscriptions by end of March 2022 hence translating to a penetration rate of 73.8%.

As at 31st March 2022, the number of active1 mobile (SIM) subscriptions stood at 64.9 million from 65.1 million subscriptions recorded by the end of 31st December 2021, and representing a mobile (SIM) penetration rate of 131.4%.

Diaspora Remittances

According to the Central Bank of Kenya (CBK), the US remains the largest source of remittances in Kenya, accounting for 59 per cent in the period.

“The strong remittances inflows continue to support the current account and the stability of the exchange rate,” said CBK in its weekly bulletin.

Respondents in the Remittances Survey addressed key challenges: high cost of remittances; hidden fees and charges such as indirect currency conversion fees; unfavorable exchange rates; limited interoperability; and slow interbank transfer processes.

Going forward, there exists opportunity for business entities in the remittance market if they can address key challenges through partnerships and better technological innovation.

Kenya Inflation Chart

Note: Month-on-month and year-on-year changes of consumer price index in %. Source: KNBS

KEY POLICY RESPONSES IN Q2.

The FY2022/23 National Budget was released earlier than is traditional, i.e. on 7th April 2022, in consideration of the government’s preparations for the upcoming General Elections in August 2022.

To finance the Budget, the Government expects to raise ordinary revenue of KES 2.14 Trillion. To this end, it has proposed several tax measures expected to generate an additional KES 50.4 Billion to the exchequer for the budget 2022/23. The increases in excise duty for certain products will mean higher prices for consumers. Another measure is the requirement for taxpayers to deposit 50% of disputed taxes in a special account at the Central Bank of Kenya before appealing a decision ruled in favour of the Commissioner at the Tax Appeals Tribunal.

VAT and Excise duty exemptions for certain sectors notably local motor vehicle and pharmaceutical manufacturers sector will be beneficial for these sectors. Microfinance institutions will also be spared the restriction on interest deduction.

Government expenditure as a % of GDP is projected to decline from 25.0% in 2021/2023 to 23.9% in 2022/2023 owing to efforts by the Government to rationalise recurrent expenditure through implementation of cost-cutting measures including parastatal reforms and alignment of resources to programmes particularly focused on the Big Four Agenda and the Economic Recovery Strategy. Development expenditure as a % of total expenditure in 2022/2023 is expected to increase to 36% primarily driven by enactment of the law requiring that development expenditure constitutes a minimum of 30% of total expenditure and restriction of the use of borrowings for development expenditure.

Top 3 winners in the 2022/23 budgetary allocation.

The education sector has been allocated 16% of the budget.

Energy, Infrastructure and ICT The Energy, Infrastructure and ICT sector has been allocated KES 368.3bn Public administration and International Relations has been allocated KES 347.0bn to strengthen administration of public services.

KENYA FINANCIAL MARKET

For Qtr 2 and going forward there are considerable downside risks in the short term to medium term. According to McKinsey’s March 2022 Economic conditions outlook, geopolitical instability is one of top risks to global and domestic economies. An increase in fossil fuel prices is bound to impact Kenyans through a corresponding increase in cost of living, occasioned by surges in transport and production costs.

Kenya is entering into an election season culminating in the August 2022 General Elections. Election periods in Kenya are typically characterized by intense political campaigns often leading to high political temperatures that cause uncertainty. These uncertainties may result to a slump in economic activity and investments as investors conserve financial reserves awaiting the outcome of the elections and resumption of ‘business as usual’.

Climate change is a major concern to the extent that it induces uncertainty in weather patterns, influencing regional crop growing conditions and pest incidence. Adverse weather conditions are expected to potentially reduce the annual crop yields and as such exposing the economy to negative shocks which will certainly impact on economic growth and by extension tax revenues. Increased expenditure pressures. The Kenyan government is experiencing financial stress stemming from record-high debt levels and overall growth in public expenditure.

Key Themes reported in Q2.

GOK bonds offered the largest returns over the first half of 2022.

According to data from Quarterly Economic Review 2022 published by the Central Bank of Kenya (CBK), the government reopened two bonds with effective tenures of 5.8 years and 11.3 years, respectively, in a bid to raise Ksh40 billion for budgetary support.

The two bonds are currently trading in the secondary market at yields of 12.6% and 13.7% – the highest potential return on investment during the period under review.

Investors also opted to take advantage of the returns from fixed deposit accounts, with the CBK revealing that the average of 6.58% interest was second only to the aforementioned bonds.

It is important to note that small savers’ accounts didn’t have this high return as their rates still averaged in and around 2.5%. It was the cash-rich companies and individuals who reaped huge returns

This is backed by the fact that fixed deposits in banks rose by Ksh33.6 billion or 2.1% to Ksh1.6 trillion during the first quarter of 2022, a much faster growth rate compared to the corresponding period last year when they were up 1.9%.

The deposit base also increased by 0.6% to Ksh4.4667 trillion in the first quarter of 2022, from Ksh4.441.9 trillion in the fourth quarter of 2021.

Banking highlights and Outlook.

The Central Bank of Kenya (CBK) enacted the Digital Credit provider’s regulations to regulate digital lenders, granting the bank the authority to license and oversee previously unregulated digital credit providers.

Centum Investment Company PLC, announced that it had entered into a binding agreement to sell its 83.4% shareholding in Sidian Bank to Access Bank PLC.

Equity Group and the International Finance Corporation (IFC) signed a partnership agreement in support of the sustainable development of Africa strategic plan by the Group which saw IFC and its partners commit USD 165.0 million (KSH 19.2 billion) towards Equity’s `Africa Recovery and Resilience Plan.

Britam Holdings, and Britam Life Assurance, jointly announced that the two firms were finalizing on an agreement to sell their stakes in Equity Group Holdings to the International Finance Corporation (IFC) and the IFC Financial Institutions Growth (FIG) Fund.

The banking sector continued to recover as evidenced by the increase in their profitability, with the Core Earnings Per Share (EPS) growing by 37.9%. The increase in EPS is mainly attributable to the reduced Loan Loss Provisions levels by the sector. There is also growth in Non-Funded Income (NFI). Non-Funded Income is income that banks earn from activities other than their core intermediation business (taking deposits and making loans) or from their investments and is derived primarily from fees including deposit and transaction fees, insufficient funds (NSF) fees, annual fees, monthly account service charges, inactivity fees, check and deposit slip fee.

This type of income is often referred to as “fee income” since fees constitute the majority of non-interest income. Upcoming financial institutions can emulate the industry practice by first finalizing on the categorization by segmenting their products offering for more value add to grow NFI.

Uncertainty surrounding the August 2022 elections coupled with the resurgence of COVID-19 infections, will see banks continue over provisioning in the medium term, albeit lower than in 2020 at the onset of the Covid pandemic.

Banks’ Operational strategies going forward.

Based on the current operating environment, the most likely scenarios for banks will be:

- Growth in Interest income.

- Revenue Diversification which can be achieved through increased adoption of digital channels, which present an avenue for an increase in fees on transactions.

- Continued Loan-loss Provisioning.

- Cost Rationalization. However, some of the banks such as NCBA and DTB-K have announced plans to open more branches with an aim of increasing their physical presence.

- Regional Expansion and Further Consolidation.

- Integration of Climate-Related Risk Management as per the CBK Guidance on Climate-Related Risk Management.

Recommendations going forward

We foresee rising cost of living leading to consumers’ disposable incomes declining. This could further fuel social unrest risks.

Expected interest-rate hikes to counter inflation will adversely affect the cost of credit and enterprises may be forced to dip into cash reserves or convert long term deposits to short term deposits.

Greater use of the digital channels is expected to lead to an opportunity for personalized communication with customers as well opportunities to grow revenues away from core business.

For financial institutions and service industry, integrating core processing software with third party systems and channels will allow a more customer-centric business approach and allow them to innovate on more personalised products.

For FinTechs, despite the decline in remittance inflows from traditional source locations such as USA, opportunities exist for send- to- account remittances with the enhancement of the mobile and internet banking platform. This presents an attractive, secure and confidential and cheaper opportunity to our customers as they no longer have to involve relatives to receive on their behalf. The downside to this is the weakening shilling against major currencies.

Government to Customer (G2C) as well as Customer to Government (C2G) transactions are expected to become more efficient with little or no human intervention as there is a focus on digitisation of government processes in view of IMF policy recommendations for better management of resources and reduction in corruption. FinTechs are expected to play an important the introduction of easier integration with government processes for citizen to government (C2B) payments.

We see the government coming up with more targeted programs to support vulnerable households especially in light of the withdrawal of the ongoing review of the fuel pricing mechanism [fuel subsidy] as recommended by the IMF. This presents an opportunity to the non-governmental sector and civil groups to participate more in the social support programmes such as Inua Jamii and the hunger support programmes.

Prepared by

research@tumainiinstitute.ac.ke

Responses